How many times have you looked at real estate prices lately and wanted to kick yourself for not buying a house 5 years ago? Am I right? Well, please don’t be so hard on yourself. Nobody has a crystal ball, and trying to time the market perfectly is nearly impossible! All you can do is learn from the past and prepare for the future. It is still a great time to buy. There is still equity to be made. There is still room to build wealth. But you can’t wait another 5 years!

So, let’s get straight to it. Today’s article was written in collaboration with Heather Wilbur, a second-generation Santa Cruz local, AND a second-generation mortgage consultant, following in her father’s footsteps. Heather is very sharp, and seriously in the know about all things lending and mortgage related. She’s got that young, fresh, and super savvy approach that instantly makes you feel that you are in the right hands, you will be well advised, and well taken care of.

Now, I often hear buyers say they are waiting to buy until they have a 20% down payment. I’m sure you’ve heard this is the best way to avoid that dreaded mortgage insurance. But Heather says, “mortgage insurance is NOT THAT BAD!”. Heather loves numbers, and without hesitation she jumped right into some striking visual buying scenarios.

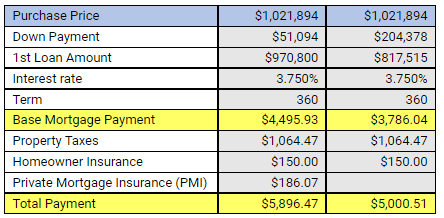

Remember the conforming loan amount in Santa Cruz County of $1,089,300 that we discussed in last week’s article? Using this loan amount, Heather lays out a comparative cost break down putting 5% down and having a mortgage insurance payment vs. putting 20% down and having no mortgage insurance payment.

Take a look at this chart:

The difference in mortgage payment from a 5% down payment with private mortgage insurance and a 20% down payment without PMI is ONLY an additional $895.96/month. The dollar difference between a 5% down payment and a 20% down is an extra $153,284!

Are you following this? Because here’s the real stunner… here’s the REAL COST OF WAITING TO BUY…

It would take 171 months (that’s 14.26 years!) to save the additional $153,284 if you were putting that $895.96/month in a typical savings account (making basically 0% return). That’s staggering! And in 14 years the cost of the home you’re looking at is going to be much higher. So you won’t have the full 20% down even then!

This is a very compelling reason to get into a home NOW instead of waiting until you have 20% saved, don’t you agree? I mean, it’s a no brainer!

With a conservative historical national appreciation rate of 5.82%, the value of that home in 14 years would be $2,255,988. And we know the overall appreciation is a LOT higher in Santa Cruz County.

More food for thought:

According to Apartment List’s National Rent Report, rental prices went up $300 per month in 2021. They don’t give specific numbers for Santa Cruz County, but we can assume it’s even higher than that.

So, here’s another great example from Heather: That extra $300 per month that’s being spent on rent, based on current rates, is equal to the cost of a $70,000 mortgage. Meaning, if that extra $300 per month is used to purchase a house, there would be an additional $70,000 in buying power that could be put towards purchasing a home.

And of course, when you purchase a home, that property continues to appreciate, helping to build wealth. When renting, the only person building wealth through real estate is the landlord. TRUTH!

I hope this look into the cost of waiting to buy has given you a fresh perspective. To take a deeper dive into your personal situation, please get in touch with Heather Wilbur 831.234.2345, heather.wilbur@myccmortgage.com, crosscountrymortgage.com/Heather-Wilbur. And tell her I sent you!

Hi there!

I believe that with Information, Preparation, and Strategy, you can achieve great success. Let me show you how!

831-345-2427 (call or text)

Jennet@AtHomeInSantaCruz.com

How I Help Buyers

How I Help Sellers

Stuff You should Know

schedule A TIME TO TALK